Are Prediction Markets Predicting the Future or Shaping It?

The Information Security Risks of Prediction Markets in Sports and News

Speed Read (Get the headlines here, and read on below)

The big picture: Prediction markets, like sports betting markets before them, can be exploited by foreign adversaries to manipulate narratives, undermine trust, and interfere with American civil discourse.

Why it matters: As news organizations increasingly reference prediction market data, market movements risk being treated as objective truth rather than the opinions of a small, motivated group of participants.

How it works: Actors can strategically place relatively small amounts of money to move markets, then amplify those moves through media and social platforms to create the appearance of legitimacy or inevitability.

The risk escalation: What begins as benign market influence in sports or entertainment can extend into geopolitics, allowing adversarial states to shape coverage of sensitive issues like elections, corporate disclosures, or regime stability.

What’s next: Prediction markets are likely here to stay, but without guardrails, transparency, and media caution, they could become another vector for information warfare rather than a neutral forecasting tool.

Now on to the full story

I’ve written before in Secure Stakes about how I think a playbook exists for foreign adversaries to abuse sports betting markets to interfere with American civil discourse and call into question the outcome of sports contests. You can read the detailed piece here, but the short version goes something like this—a foreign nation-state adversary can use real or AI-generated content related to gambling to generate narratives on social media that make it look like games are not fair. It could take many different routes, but one easy one to highlight as an example is something like AI-generated video of a referee gambling on a game he would later officiate.

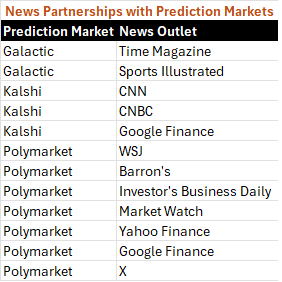

The recent spate of agreements between news organizations and prediction markets brings me back to this potential threat stream and I want to dig into it a bit more. Reputational harm, the erosion of trust, sports betting scandals, and national security risks oddly do have a through-line between them so I think it is helpful to try and connect them.

I understand the allure of prediction markets in reporting the news. They give reporters and on camera news talent numbers to point to and charts to reference. Most cable news outlets have a data or numbers guy now who walks viewers through the latest poll about the topic du jour and what it means for potential policy changes or the viewers’ day to day lives. But with prediction market data there is no need to wait for the latest poll. It’s all there on any topic they might want to talk about—the Super Bowl, a potential recession, March Madness, a potential war breaking out, a blockbuster movie release, or the projected outcome of an upcoming presidential election.

So, what does all of this have to do with foreign interference? I have not seen a ton of news coverage yet pointing to prediction market data, but I assume that it is coming and while it might be jarring at first eventually, we will all get used to it. So where do the risks lie? As market data is referenced more regularly by news outlets it will be taken perhaps with a grain of salt at first in the way that polling data about, say, a political issue is referenced now. But given how prediction markets refer to themselves as the arbiters of truth there is a real possibility that reporters will treat market data as a true and accurate reflection of reality and not the opinions of a relatively small segment of the public. And this leaves America’s adversaries (or really anyone who wants to shape the narrative of a given topic) with a real opening.

Let’s say there is a market concerning the potential box office opening of an upcoming blockbuster movie. The market poses the question “Will the opening weekend net more than $100 million?” Why wouldn’t a movie studio invest $50,000 or $100,000 of its marketing budget into buying the “Yes” side of that market and then have its PR team highlight the market movement to entertainment reporters to push ticket sales? To be clear—this is legal, and movie studios and countless other industries use PR teams to influence public opinion all the time.

In the sports context, if a newsroom’s sports reporters are going to rely on market data like they do on performance analytics, then they too are vulnerable to manipulation. Like in the instance above, an agent could invest money into something like a prop market around an MVP award that may influence voters. The award for the player could trigger additional bonuses in the player’s contract at the end of the season. Again, sports teams engage in PR campaigns for their athletes and teams every year but the example highlights the broadening surface that prediction markets provide and the directly links to notions of trust and legitimacy.

While those two examples might sound benign, they do have the potential to further undermine a fan’s trust in the fairness of sport. Beyond that, when you move into the realm of geopolitics that is where I think the situation becomes more serious. I recognize that this perhaps moves beyond the core focus of this newsletter (homeland security AND sports gambling) but I do think it still warrants pointing out the potential threat stream as it has the potential for truly negative impacts.

Let’s say that Iran or Russia, or China has hacked a Fortune 50 company’s corporate email infrastructure (a shocking premise, I know) and has access to privileged or confidential business information that might be announced in an earnings call or might otherwise affect the news cycle. If there is a prediction market related to that bit of information the adversary nation could certainly seek to profit from it, but they could also strategically “invest” in whatever side of the market they wanted to try and move or shape news coverage of the event. Even without the cyber espionage they could affect news coverage. As of the writing of this piece, there is a Polymarket market asking whether the Iranian regime will fall by January 31, 2026. It has just over $1 million in volume. A $100,000 investment could really move that market and potentially affect news coverage. If you consider domestic issues in the U.S., it could also allow foreign adversaries to shape news coverage of potentially divisive topics in the U.S. as well to further divide the American public.

I write this not to call for the abolishment of prediction markets but rather to highlight certain risks that I do not think people are considering yet. As with many new technologies, people often see the promise first, and only the promise first. Only after something bad happens do we awaken to the downsides. As prediction markets proliferate and rush to scale and grow and insinuate themselves in our lives as the arbiters of truth they should also be working with policymakers and other stakeholders to build guardrails that protect the public from potential harm. Media companies should develop transparent standards for use of prediction market data, there should be disclosure rules and requirements around large trades, defined rules for market integrity monitoring, and rules around foreign participation in certain markets.